I was recently inspired by this Twitter exchange between The Minimalists and The Container Store (yes, this really happened).

The logic here is sound, but don’t let it stop you from treating yourself once in a while! -CZ

— The Container Store (@ContainerStore) May 27, 2018

Treat yourself? Those are the words of a playground drug dealer. Going to the @ContainerStore to fight clutter is like visiting a gourmet cake shop to combat obesity. https://t.co/ftJSVnWFzP

— The Minimalists (@TheMinimalists) May 28, 2018

Then I came across this USA Today article that started on the right track but ultimately came to the conclusion, “Some of us probably ought to live with less. Many of us deserve to live with more.”

What’s wrong with “treating yourself” or convincing yourself that you “deserve” something? Well, maybe nothing or possibly a lot. It all depends on what that means for you and making sure it doesn’t add up to a hefty amount of lifestyle inflation.

Lifestyle Inflation Defined

What is lifestyle inflation?

- “Lifestyle inflation refers to increasing one’s spending when income goes up. Lifestyle inflation tends to continue each time someone gets a raise, making it perpetually difficult to get out of debt, save for retirement or meet other big-picture financial goals. Lifestyle inflation is what causes people to get stuck in the rat race of working just to pay the bills.” — Investopedia

Ah, the dreaded work-and-spend cycle. Except it becomes the work-spend-get paid more-spend more cycle.

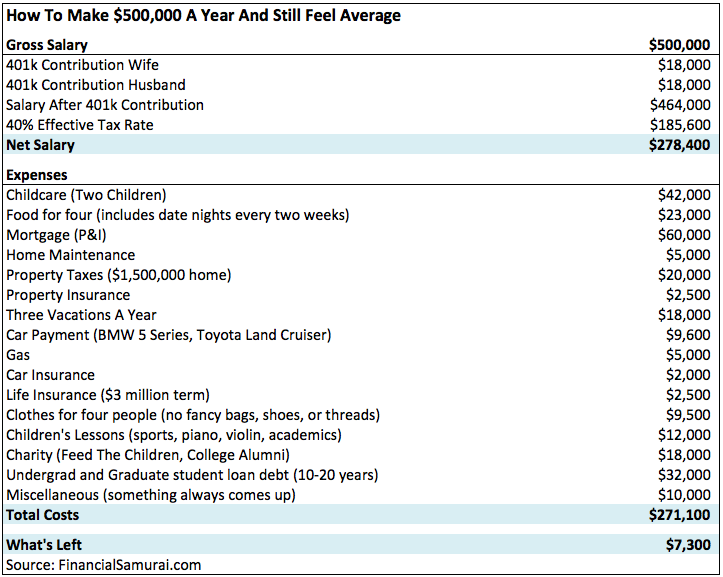

Take this real-life example of a couple who have a gross salary of $500K, a net salary of $278K, and only manage to save $7K per year. Yeah, lifestyle inflation is real.

Of course, there’s little sympathy for the lack of savings (as shown in this parody budget breakdown):

Why a couple earning $500,000 a year can still find it hard to get by pic.twitter.com/6s10MTRLfx

— Dan Amira (@DanAmira) March 24, 2017

But, to really understand lifestyle inflation, we need to get down to the root cause.

Why we have Lifestyle Inflation

We’ve all heard the phrase “keeping up with the Joneses,” and Dave Ramsey summed up lifestyle inflation as “more money, same problems.” While keeping up an image in mainstream society is definitely part of the equation, what else is at play here?

A big part of it is related to perceived happiness. Many people believe that more equals happier. But, a decades-old concept and modern research prove that wrong.

The concept is called the hedonic treadmill (or hedonic adaptation). Here’s a quick overview and video that do a nice job of summing it up:

- “The hedonic treadmill, also known as hedonic adaptation, is the observed tendency of humans to quickly return to a relatively stable level of happiness despite major positive or negative events or life changes. According to this theory, as a person makes more money, expectations and desires rise in tandem, which results in no permanent gain in happiness.” — Wikipedia

So, we chronically overestimate how happy something is going to make us over time.

My Own Story of Lifestyle Inflation

I personally think my story is less about “keeping up with the Joneses” or perceived happiness. Instead, I think it relates back to the beginning of this post — “treating myself” or “I deserve this” (maybe that makes me a typical Millennial after all). Although, I’d like to think this is less about “entitlement” (believing you have a right to something), and more about “time to cash in on some of my hard work” (acting on an option you’ve created for yourself).

Here’s the story in a nutshell. The tradeoff of selling my soul to the rat race was a ton of hours, work that wasn’t fulfilling, decreased physical and mental health, increased stress and anxiety…the list of bad stuff goes on and on.

On the flip side, income and net worth grew exponentially. I increased my base salary 350% over the course of a decade. So, what did my wife and I do? Well, we bought a house. We lived in our first house for five years. And then what did we do? We bought our second house. But we spent 150% more on our second house.

But, but, but…it was going to be our “forever home” (that’s what I said about the first house too). And here we are, a year and a half later, and we are most likely moving halfway across the country in a few months. And, those feelings of “treating myself” and “I deserve this” — happiness is back to baseline after 12-15 months in the house. Business as usual.

On the charge of lifestyle inflation, we are definitely guilty. Home-related expenses for 2017 were 50% of our total expenses (this includes mortgage, all utilities, HOA, all home services and maintenance, all home furnishing, home supplies, etc).

The good news is that we’ve avoided lifestyle inflation for many other spending categories: vacations, travel, entertainment, clothing, etc (luckily, we haven’t really bought into experiences or things). The bad news is lifestyle inflation has creeped in on two of the biggest expenses: home and cars. Those two pieces of the pie are bigger than the others, so all the savings in other areas can’t offset them.

So, with this newfound awareness, where do we go from here?

Reverse Lifestyle Inflation & Upgrade Your Life By Downshifting

If you are able to completely avoid lifestyle inflation in your life, then you are ahead of the game! For the rest of us, I guess we need to personally live through it to really learn the lesson. Even if deep down we think we know better.

Define your goals and your idea of success: You have choices to make. Just like how everything you eat or drink can be viewed as medicine or poison for your body, every money choice you make is the same. Is your goal to accumulate a bunch of stuff? Is it to travel or engage in a bunch of experiences? Or, are you saving for financial freedom? For me, the discovery of FIRE (Financial Independence, Retire Early) was a life-changing aha moment. If you’re spending your money now, you’re effectively saying you’re OK with not having that money saved and invested so you can have financial freedom at an earlier age.

Track your progress: Track every expense transaction, at least for awhile. It’s eye opening. You need data. And not just random examples found on the internet. You need your own personal data. Without the objective data and insights, you are operating in the subjective dark (“I think I’m spending less, but I’m not really sure”). I started tracking every single expense transaction last year, and I was able to analyze it all in early 2018 to make a plan for this year.

Avoid creating a “new normal” for yourself: Money shouldn’t be viewed as a coping mechanism to help you get through days you don’t enjoy (“I worked hard so I deserve this”). Brands aren’t your friend, and there’s no such thing as a good deal (I know this from a decade spent in business/marketing…they know exactly what margins they need to make). Shop resale sites. We’ve furnished 80% of our house from Craigslist. As we learned above, the hedonic treadmill only allows money to buy short-term happiness at best. It’s a band-aid solution. For me, no purchase in the world was going to change the fact that I wasn’t using my time the way that I wanted to:

- “I’ve learned that there is nothing more consistent with unhappiness than spending your time in a way that doesn’t serve who you are.” — Scott Dinsmore

Downshift to simple living: My existential crisis planted the seed and put me on the path toward downshifting to simple living, slow living, and voluntary simplicity. I’ve decreased my wants/desires as well as my perceived needs, but there’s still a long way to go. Unintentional consumption is becoming a thing of the past. We now make intentional choices about where we will spend and where we will cut and are designing the slow and simple living life we want.

It’s never too early or too late to fight lifestyle inflation in your life: You will need to course-correct again and again (as outlined in this great first-hand experience over many years). I also love this perspective:

- “During the summer of 2010 at 31 years old I quit lifestyle inflation. Because I was at work and realized there were people 25 years older than me still doing the nine-to-five grind. I thought, ‘What kind of life is that? I can’t do that to my future self’…The old Chris worked to earn and earned to consume. And my new approach was to work to earn, earn to save, and save to invest, so I could stop working. That’s freedom.” — Chris Reining

Well, it’s the summer of 2018 and I’m 33. So, I guess this is a good time to start! I wouldn’t trade this new level of awareness and outlook on life (and money) for anything. You can live like the fisherman now.

Slow Living Resources

Slow Living Life Hacks | Slow Living Challenges | Slow Living Online Forums & Communities | Slow Living Quotes | Slow Living Book Summaries | Slow Living Videos

You can follow Sloww via email using the form field below this post or on social media: Twitter | Facebook | Instagram | Pinterest | Medium | Reddit | Quora