Let’s continue to stay on the current theme: money. In the last two posts, we learned about average annual expenses and how much annual income is enough:

- The 80/20 Rule for Money: The 3 Ways Americans Spend Most of Their Money (& How You Can Save More)

- How Much Income is Enough Money for Well-Being, According to Research?

To take it a step further, I thought it would be interesting to put the data into action—compare our personal household spending against the average American spending.

Call me weird, but I genuinely look forward to each January because I finally get to analyze a year’s worth of our spending data. When used as a tool, data can be your friend. Without it, your spending is a guessing game.

So, how did we do?

Money Showdown: Average American Spending vs Sloww’s Household Expenses

Data Sources: I’m using the latest data released from the Bureau of Labor Statistics (BLS) Consumer Expenditure Survey (2017 data that was published in September 2018). For personal data, I’m using our 2018 household expenses for comparison since it’s the most recent and relevant.

BLS Data: Let’s start at the highest level—the “big three”: 1) Housing, 2) Transportation, and 3) Food. The BLS Consumer Expenditure Survey data shows that 62% of all spending comes from these three categories.

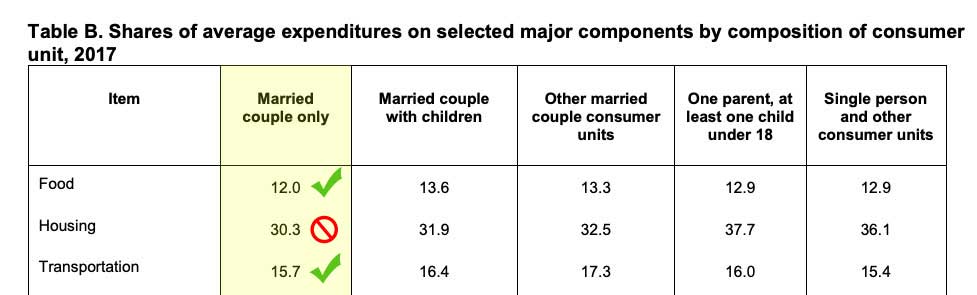

If you want to see spending percentages specifically for your type of household, you can use Table B below. I’ve highlighted our current household type (married couple with no children, other than our two bad dachshunds) which shows that the big three expenses total 58% of all spending.

Sloww’s Household Data: You’ll notice in the table below that I’ve also used colored icons to mark where our personal data is in alignment (green) and out of alignment (red) with the BLS data.

The first thing I want to note is that our household “big three” spending categories align with the BLS data. However, food was a larger category than transportation for us the last two years:

- 2018 Sloww Household Top Spending Categories: 1) Housing, 2) Food, 3) Transportation

- 2017 Sloww Household Top Spending Categories: 1) Housing, 2) Food, 3) Transportation

This is likely because we own our cars in full (no ownership/lease payments), and transportation expenses (gas, maintenance, etc) are pretty minimal in the Kansas City area.

In terms of the percentages, we were right in line with the food percentage and well under for transportation outlined in the table below. However, we are totally blowing it on the housing percentage. As I’ve mentioned before, we were guilty of lifestyle inflation and purchased a McMansion in the suburbs (okay, not exactly a McMansion by these standards but still way more house than we need). It’s been a good learning lesson to say the least, and the house will be a past memory soon (more to come on that in the near future!). All in all, we were way above the 58% BLS mark for the big three expenses. For us, the 80/20 rule held true, and the big three spending categories made up a whopping 76% of our total spending.

While housing is currently a lopsided expense for us, there’s another reason the big three expenses made up such a large portion of our spending—it’s simply because we’ve drastically reduced spending in almost all the other expense categories.

When you look at the full data in dollars instead of percentages, here’s how things shake out for us—we are under or in line with the average American expenses for apparel, transportation, healthcare, entertainment, personal care, and more:

In addition to housing, food is one other category where we are currently over. This is an area I want to dig into deeper to find savings because we shouldn’t be over the average in food given it’s just the two of us and we don’t go out often. Although, we do have a Costco membership, and I categorize supplements and vitamins in the food category which definitely add up over the course of a year.

And now, what you’ve probably been waiting for…

How we Cut our Total Annual Household Spending by 30% in One Year (2018 vs 2017)

I mentioned author Vicki Robin in the previous post, but I think this quote is so powerful that I’m going to share it again here:

The new roadmap says that there is something called ‘enough’…’enough’ is this vibrant, vital place…an awareness about the flow of money and stuff in your life, in light of your true happiness and your sense of purpose and values, and that your ‘enough point’ (having enough) is having everything you want and need, to have a life you love and full self-expression, with nothing in excess. It’s not minimalism. It’s not less is more (because sometimes more is more), but it’s that sweet spot, it’s the Goldilocks point. Enough for me is one of the absolute fulcrums between the old roadmap for money and the new roadmap for money…Once people start to pay attention to the flow of money and stuff in their lives in this way, their consumption drops by about 20-25% naturally because that’s the amount of unconsciousness that you have in your spending. So, when you become conscious, that falls away and many people say they don’t even know what they used to spend their money on. — Vicki Robin

You might scoff at that 20-25%, but it is real!

HOW?

The short answer: By being much more intentional about everything in our lives (including everything we spend money on). Exactly what Vicki Robin said.

The long answer: I’ve been tracking our monthly expenses for years at a high level—total cash flow in/out of our bank accounts each month. Beginning in 2017, I started tracking every expense. Instead of using an automated tool like Mint or Personal Capital (although I do use Personal Capital (referral link) for net worth tracking), I decided to track our expenses manually in Excel. Although time consuming, I figured this would give me the highest level of control in terms of categorizing each expense accurately and then analyzing the data a zillion different ways. After analyzing our 2017 spending as a baseline, we set a rough 2018 plan for different spending categories.

In top-level spending categories, there was a reduction in every single one except home utilities.

In terms of individual expense types, the following happened:

- Expense Increases YoY (2018 vs 2017): mortgage (we moved to a more expensive house in 2017), house HOA, phone bill, gifts/donations, and our gas bill.

- Expense Decreases YoY (2018 vs 2017): vacation/trips (slow travel), restaurants, electric bill, gasoline, home decor/supplies, dog vet/grooming, clothing (both my wife and me), wine/liquor stores, fast food, car maintenance, dog boarding, and more.

I guess that “buy nothing year” for clothing helped out after all! The bulk of the 30% reduction in expenses was from eliminating spending on non-necessities which can be upwards of 50% of American household spending.

Your Turn

Ready to say goodbye to keeping up with the Joneses? Do you know if you spend more on things vs experiences? I would highly encourage you to track your finances (even if it’s using an automated tool) starting now. Let 2019 be the first year you have a full year of spending data at your fingertips. You may think you know where all your money goes, but research shows our estimates can be way off (same goes for how we think about our use of time).

Use the BLS data as a baseline for comparison and intentionally find ways you can cut back spending. How will you define enough? I know our big next step is to tackle the #1 expense: housing.