Have you heard of the “monkey mind”? It’s often referenced as a Buddhist term meaning unsettled, restless, confused, indecisive, and uncontrollable—among many other things that don’t sound great.

Maybe worse: what happens when your monkey mind mutates into a money mind?

I recently received a message from a Twitter friend:

- “I finished your Ikigai 2.0 eBook this weekend. Thank you, it has helped me a lot. I like your views on money. I think today’s society, especially here on social media, is totally obsessed with money which keeps them from really living a full life. You can earn money, even a lot, but it will not give you completeness and happiness. There is no one talking about this, only you. Social media absolutely empowers this. It looks like a disease.“

It shocked me to hear that I was apparently the only one talking about these views of money. Even in the little corner of “lifelong learning Twitter” where I’m active, it’s not possible to completely escape all the subcultures of “money Twitter” and their overwhelming obsession with finance, investing, stocks, stonks, crypto, Bitcoin, Dogecoin, you name it. Money, money, money.

Speaking of the “disease,” Twitter king and tech entrepreneur/investor Naval Ravikant—who has a net worth estimated at more than $60,000,000—recently admitted:

- “There’s no number that’s going to turn off an unrelenting desire for money. That’s a scorecard that just doesn’t stop. Excessive greed occupies your mind constantly. I’m not speaking this as some holier-than-thou sage who has conquered this. I’m speaking this as a victim of this—no matter how much money I make, it’s never enough. It always occupies my mind. It’s always a constant source of anxiety. I can’t turn it off … All I can do is acknowledge, ‘This is the mental disease that I have’ … Maybe eventually I’ll realize the cost of the disease is too high and I’ll drop it. Until then, I’m resigned to living with it.”

Naval is in his mid to late 40s. Let’s say he lives another ~50 years to be 100 years old. He, his wife, and his kid(s) would have to spend over a million dollars a year to run out of money assuming he didn’t make another dollar. I get this is oversimplified (“But inflation!” “But net worth isn’t all cash or liquid assets!” etc.). Still, you get a rough picture. It’s a ton of money. He has money, but he hasn’t conquered his money mind.

What is going on? I should clarify that I’m not intending to single out Naval—I’m only referencing him because he displays a rare combination of wealth, self-awareness, and vulnerability. Many other wealthy people likely share the mental disease but would never admit it. I admire Naval for doing so. I should probably also clarify that I’m not downplaying legitimate mental diseases. In the context of this post, I’m using “mental disease” in the sense of mimesis/memes. An obsession with money has to be one of the most viral memes in human history—a mimetic desire affecting human minds generation after generation. (Note: For more on memes, see Richard Dawkins. For more on mimetic desire, see René Girard.)

I’m not a “holier-than-thou sage” either, but I do feel like I’m well on my way to mastering my mind when it comes to money. Yet, I’m financially worth a tiny fraction of Naval. I’m not a multimillionaire, and you don’t have to be either.

This post is a “money mind manifesto” sharing what I’ve learned and experienced so you can master your money mind. You don’t have to live and learn the hard way.

Money Mind Manifesto — Master Your Mind from the Mental Disease of More Money

The image above is from the cover of Morgan Housel’s book, The Psychology of Money. What do you see? A brain of money? A maze of money? Either way, you’re right. When it comes to money, one of the biggest battles is in your mind:

- “My mind on my money, and my money on my mind.” — Snoop Dogg

What can we learn from the rich?

“It is not the man who has too little, but the man who craves more, that is poor.” — Seneca

How many rich people living and learning the hard way will it take for us to learn important money (and life) lessons ourselves? Even though Naval Ravikant admits he has the “mental disease,” he knows better:

- “Making more money beyond a point doesn’t actually change anything in your mindset … There are some things that just cannot be purchased on the market: a fit body, a calm mind, and a house full of love. These things cannot be bought. They must be earned … You have to go and get them yourself regardless of how much money you have. We’re used to getting everything in our lives with money.”

Maybe you’ve heard of ex-Google executive Mo Gawdat. He bought two vintage Rolls-Royce cars online just because he could. But, he couldn’t buy happiness for any amount of money and concluded:

- “Once you get your basic needs met more money doesn’t make you happier. There is nothing that you can do to achieve happiness by buying it.“

If you haven’t heard of Naval or Mo, you’ve most likely heard of Jim Carrey. His net worth is estimated at upwards of $200,000,000. What does Jim have to say about it?

- “I’ve often said that I wish people could realize all their dreams and wealth and fame so that they could see that it’s not where you are going to find your sense of completion.”

The world needs more examples of people who became wealthy or were born into money but either: 1) did not follow the normal path of excessive consumption, or 2) did and course-corrected after learning the hard way:

- Buddha: Perhaps the most well-known example. By tradition, he was destined by birth to the life of a prince. At 29, he left the palace which started his awakening journey. Buddhist scriptures say that the future Buddha felt that material wealth was not life’s ultimate goal.

- Gandhi: Many don’t realize Gandhi was not born into a simple living lifestyle. In fact, at 18 years old, he went to London to study law and dressed in Western clothing. Gandhi was 23 years old when a specific incident changed the course of his life.

- Warren Buffett: One of the world’s richest people. Buffett gave the largest charitable donation in history and still lives in the house he bought in the 1950s. He splurged on a private jet but otherwise seems very frugal relative to his wealth.

- Chuck Feeney: Donated $8B of his wealth—keeping only $2M for him and his wife. He’s now given away 375,000% more money than his current net worth. Believes it’s a lot more fun to give while you live than give while you’re dead.

- Tom Shadyac: Multi-millionaire director of movies like Ace Ventura, Bruce Almighty, and Patch Adams. Created the documentary “I Am” which explores his abandonment of his materialistic lifestyle. Sold possessions and 17,000 sq. ft. mansion, donated money, and opened a homeless shelter.

What do the rich want more than anything else? Time.

- “I can buy anything that I want, basically, but I can’t buy time.” — Warren Buffett

- “There’s nothing that brings me as much joy and happiness as an empty calendar.” — Naval Ravikant

There’s a well-known lesson that more money just amplifies who you already are. It’s not going to buy you the best things in life or resolve any of your internal issues:

- “The first thing you realize when you’ve made a bunch of money is that you’re still the same person … Money is not going to solve all of your problems; but it’s going to solve all of your money problems.” — Naval Ravikant

- “External solutions for internal problems don’t exist.” — @thisisdebonair (Twitter)

Key Point: The rich confirm that the best things in life cannot be bought because the best things in life aren’t material “things” at all. If you don’t feel a sense of peace, freedom, and wholeness already, more money won’t give them to you. Money only solves money problems. And, no amount of money buys you more time.

Why does this continue to happen?

“He who is not satisfied with a little, is satisfied with nothing.” — Epicurus

With all the warnings from wealthy people throughout history and today, why do so many keep pursuing money above all else?

Maybe some are stuck “keeping up with the Joneses.” Consumerism and lifestyle inflation aren’t new phenomenons:

- “Advertising: The gentle art of persuading the public to believe that they want something they don’t need.” — Ad Sense Journal (1905)

- “Americanism: Using money you haven’t earned to buy things you don’t need to impress people you don’t like.” — Robert Quillen (1928)

Alan Watts was talking about this decades ago:

- “If you say that money is the most important thing, you will spend your life completely wasting your time. You’ll be doing things you don’t like doing in order to go on living, that is, to go on doing things you don’t like doing.“

Maybe some are suckered into a belief in the “American Dream.” When interpreted as “upward socioeconomic mobility,” the American Dream is mostly a myth. Not only does the belief of the American Dream not match reality, but many are trading leisure time for more work in pursuit of the myth. Some say it should be called the “Canadian Dream” or “Scandinavian Dream” to better reflect the reality that other countries have more socioeconomic mobility.

Maybe some want to stockpile money for “later in life.” But, we all know know “later” may never come. And then what?

- “You‘ll never see a U–Haul behind a hearse. I don’t care how much money you make, you can’t take it with you. It’s not how much you have; it’s what you do with what you have.” — Denzel Washington

Maybe some want to hand wealth down to children/grandchildren. But, I’m pretty sure I saw research at some point that showed intergenerational wealth is gone within a few generations.

Perhaps the most compelling explanation? Maybe some simply think the experience will be different for them—that they’ll be anomalies in the data—where more money is more everything else. Tim Ferriss offers an interesting perspective:

- “People don’t want to be millionaires—they want to experience what they believe only millions can buy.”

OK, let’s walk through this. Ask yourself these questions:

- Do you know why you want money?

- What are you going to do if/when you have a bunch of money?

- Will you buy a big house and nice car?

- Travel to exotic places and eat exotic foods/drinks?

- Buy some fancy stuff to fill your new big house?

- And then what?

Literally play those questions out in your head. Use your imagination. Visualize your life. Go even deeper by asking yourself these 35+ lifestyle design questions.

The “big three” annual expenses are housing, transportation, and food. On average, they account for ~60% of annual spending each year. So, odds are you’d upgrade those. Naval Ravikant says he checked all the boxes with the things money can buy—including the experience side with expensive travel and exotic food/drink. And, you’ve already seen his conclusions.

The “And then what?” question is critical. Ask yourself that question over and over and over again. Don’t get trapped as the tourist/businessman in this short story. Don’t take the roundabout way to get what you actually wanted in the first place.

Key Point: Despite growing warnings from the rich, generation after generation is still obsessed with money. The memes continue to virally replicate and the mimetic desire is as strong as ever. While there are likely many contributing factors to this, my hypothesis is that most people simply think the experience of being wealthy will be different for them—that more money will be more everything else and solve all internal and external problems. Hence, so many people continuing to live and learn the hard way.

Is there such a thing as “enough” money?

“The opposite of more is enough.” — William Paul Young

If more doesn’t equal more, then how much money is enough? Does quantitative research support the qualitative experiences?

There are research studies to support certain numbers, but the reality is that it will be different for different people in different life situations in different life stages. What I directionally take away from the research is that there is a point of diminishing returns where adding more money has no affect on emotional well-being (aka happiness).

- “Much of our everyday human experiences are just not affected much by money.” — 80000Hours.org

This is essentially what the rich told us, but now we have some data to back it up. Even better? The amount of income the research shows isn’t millions or even hundreds of thousands of dollars a year. No matter who you are or where you live, there are satiation points. Some of the research studies even describe “turning points” where more not only wasn’t more, but more was actually a negative. How so? Think about increasing your income through a promotion at work only to also get additional work, a busier schedule, and more stress.

- “The difference between earning $20,000 and $40,000 is huge and life-changing. The difference between earning $120,000 and $140,000 means your car has slightly nicer seat heaters. The difference between earning $127,020,000 and $127,040,000 is basically a rounding error on your tax return.” — Mark Manson

When it comes to enough:

- “There are two ways to get enough. One is to continue to accumulate more and more. The other is to desire less.” — G.K. Chesterton

As we’ve seen, the “accumulate more and more” approach doesn’t lead anywhere. We could keep adding zeros to net worth, but it wouldn’t matter. At some point, I recall coming across research that showed that every income level thinks “enough money” is 2-3x their current amount. So, it’s a common psychological fallacy.

The “desire less” approach is not only the simpler way to enough, it’s also the one that’s likely more in your control.

Let’s start with a baseline. The Bureau of Labor Statistics (BLS) does consumer expenditure surveys every year. The average consumer unit spends a little more than $60,000 in annual expenses. Do you know how much you spend a year? Do you know spending breakdowns by categories? If not, the first step is to figure out where all your money is going. (Tip: I use a combination of Personal Capital and a manual Excel spreadsheet to track our household spending. If you think a manual spreadsheet sounds terrible, just remember that the less the spend the less you have to track. Win-win.)

Once you know your baseline spending, the next question is whether or not you can get your expenses any lower. Once my wife and I started to wake up to our unconscious consumption and begin more intentional living, we were able to cut our expenses by 30% in a year! And, guess what? That amount is right in line with what Vicki Robin, author of Your Money Or Your Life, says you should expect:

- “The new roadmap says that there is something called ‘enough’ … ‘enough’ is this vibrant, vital place … an awareness about the flow of money and stuff in your life, in light of your true happiness and your sense of purpose and values, and that your ‘enough point’ (having enough) is having everything you want and need, to have a life you love and full self-expression, with nothing in excess. It’s not minimalism. It’s not less is more (because sometimes more is more), but it’s that sweet spot, it’s the Goldilocks point. Enough for me is one of the absolute fulcrums between the old roadmap for money and the new roadmap for money … Once people start to pay attention to the flow of money and stuff in their lives in this way, their consumption drops by about 20-25% naturally because that’s the amount of unconsciousness that you have in your spending. So, when you become conscious, that falls away and many people say they don’t even know what they used to spend their money on.”

Vicki Robin’s perspective on enough pairs nicely with Lynne Twist’s:

- “Sufficiency is a place of wholeness and completeness and deep understanding of who we are. And it’s almost impossible to get to enough-ness or sufficiencies in a world that exalts what I call the ‘myth of scarcity’—which is a mind-set, an unconscious, unexamined set of assumptions of ‘not enough’ … It’s not just there is not enough, it’s not enough. We’re not enough. I’m not enough. And that deficit relationship with ourselves is the source of so much of our suffering.”

Let’s say you figure out your baseline spending and cut your expenses by 20-25%. Can you go even lower? Yes.

Naval says:

- “The desire to make money is very hard to turn off. It’s not like you can turn it on at max and then you can turn it off at some pre-set number.”

I guess he hasn’t heard of the FIRE (Financial Independence Retire Early) movement—where you quite literally turn the desire for money on max and then turn it off at a pre-set number. How? By calculating your necessary net worth to be financially independent and retire early based on your preferred lifestyle’s annual expenses. It seems that FIRE advocates are living on $25-40k/year (including those with kids). Pete Adeney, aka Mr. Money Mustache, has a great video that I watch once a year:

Can you get your expenses even lower? Yes! You could go even further to the ERE (Early Retirement Extreme) movement—where you learn skills to be a Renaissance human, apply systems thinking to your lifestyle design, and eliminate monetary expenses through a strategic combination of simple living, anti-consumerism, DIY ethics, self-reliance, resilience, and more.

ERE adherents spend between $4k/household/year and $16k/household/year. Founder of ERE, Jacob Lund Fisker, has been spending roughly $7k/year for decades now. He became financially independent at age 30 while never making more than $41k/year up to that point. His net worth is currently 129 years of his living expenses! Here’s his take on spending money:

- “Spending money mainly serves to resolve friction from inefficient lifestyle design. And for us, there’s just not a whole lot of friction left anymore except real-estate, taxes, and insurance premiums (which account for nearly 60% of our budget). We consider spending money a failure to solve our problems by smarter means.”

And his take on needs vs wants:

- “There are no such things as needs and wants … It’s therefore pointless to argue about the difference or make lists of needs and wants. The problem is that needs and wants don’t fit on two different lists. They fit on one list where they’re ranked according to value rather than price. Needs and wants are different in degree, not in kind … The ultimate goal is maximizing total value while minimizing the total price.“

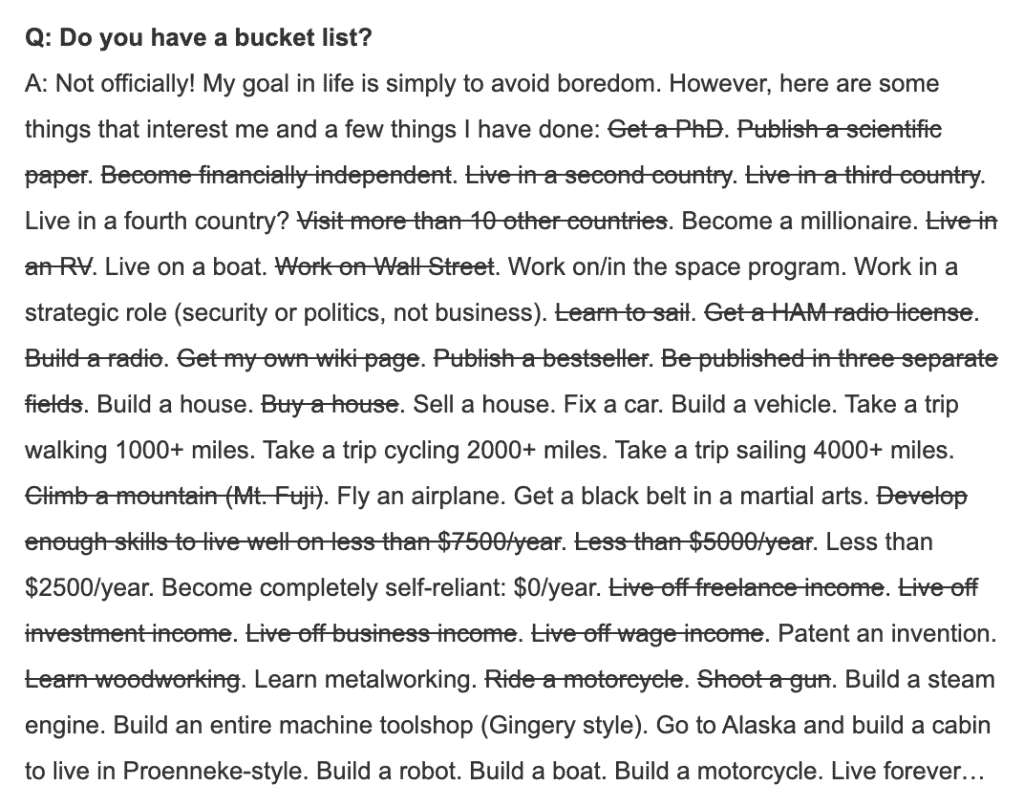

If you think he lives a boring limited life, think again. This is his unofficial bucket list:

There’s one more distinction we need to address about “enough.” It’s not about poverty. It’s about simplicity. Duane Elgin, author of Voluntary Simplicity, says:

- “Poverty is involuntary and debilitating, whereas simplicity is voluntary and enabling. Poverty is mean and degrading to the human spirit, whereas a life of conscious simplicity can have both a beauty and a functional integrity that elevates the human spirit. Involuntary poverty generates a sense of helplessness, passivity, and despair, whereas purposeful simplicity fosters a sense of personal empowerment, creative engagement, and opportunity.”

Key Point: Quantitative research backs up the qualitative experiences of the rich: yes, there is such a thing as “enough” where more money hits diminishing returns on emotional well-being (and can even become a negative). You can use the data and your own current spending to figure out your baseline. From there, your definition of enough is up to you. How simple can you make your lifestyle? Just because the average “consumer unit” spends $60k per year doesn’t mean you have to—especially now that there are growing examples of people living on $40k, $25k, $15k, $5k per year.

How do we transcend the money mind?

“You have succeeded in life when all you really want is only what you really need.” — Vernon Howard

The main point is that money isn’t the main point. Money isn’t inherently good or bad. But, prioritizing money above all else—with no defined end in sight—is where many go wrong.

If this is “normal”:

- Doing work you hate to make money

- Spending money you don’t have

- Buying things you don’t need

- Trying to impress people you don’t like

- Influenced by marketing

Then we need to create a new normal:

- Doing work you love to make money

- Spending money you have

- Buying only things you need

- No need to impress people

- Immune to marketing

It may sound like an unachievable ideal, but it’s becoming increasingly possible:

- The “money middle way” (🔒) outlines the chronological order of how I personally had to learn money lessons the hard way and course-correct over time.

- The Ikigai 2.0 eBook teaches you how to get to know yourself and make money meaningfully as a byproduct of being yourself.

- Sloww Stage 1 features 75+ posts on intentional living: slow living, simple living, minimalism, financial independence, and more.

- Sloww Stage 2 features 75+ posts on habits, lifestyle design, life purpose, happiness, and more.

- Sloww Stage 3 features 75+ posts on systems thinking, lifelong learning, human development, spiritual growth, and more.

Start prioritizing peace:

- “Until you make peace with who you are, you’ll never be content with what you have.” — Doris Mortman

Start prioritizing freedom:

- “Your freedom is more important than money. It is better to live the kind of life you want than to earn more and be constrained. Don’t sell your freedom.” — Haemin Sunim

Lastly, perhaps the smallest, simplest trick is also the most significant:

- “If you worship money and things — if they are where you tap real meaning in life — then you will never have enough. Never feel you have enough … On one level, we all know this stuff already … The trick is keeping the truth up-front in daily consciousness.” ― David Foster Wallace

Key Point: Start putting money in its proper place in your life. Start defining your new normal and designing an intentional lifestyle. Keep the truth up-front in daily consciousness and transcend your money mind.

Please let me know in the comments:

- Where are you in your own journey?

- Have you mastered your money mind?

- What has been the most helpful for you?

You May Also Enjoy:

- Everything from Money to The Meaning of Life: Wisdom from “The Almanack of Naval Ravikant” (Book Summary) + 🔒 Premium Synthesis

- A Systems Approach to Lifestyle Design: “Early Retirement Extreme” by Jacob Lund Fisker (Book Summary) + 🔒 Premium Synthesis